jersey city property tax rate 2020

Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents.

. BERKELEY HEIGHTS 4176 CLARK 8890 CRANFORD 6583 0210 ELIZABETH 29948 S010976 S02 2031 FANWOOD. 587 rows County 2021 Average County Tax Rate 2020 Average County Tax Bill. 252 551721 252 05 252 51 252.

2021 TAX RATES TOWNCITYBOROUGH RATE PER 100 SID. Find Jersey Online Property Taxes Info From 2022. 189 of home value.

1 Since 2018 the state of NJ has reduced 155 million of education aid to Jersey City. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Jersey County Property Tax Inquiry.

The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. And while the average property tax bill in the state and in each municipality tells us how much. The average 2020 New Jersey property tax bill was 8893 an increase of 157 vs.

78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Real property is required to be assessed at some percentage of true value.

Overview of New Jersey Taxes. Make checks payable to City of Jersey City. Homeowners in this Bergen County borough paid an average of 16904 in property taxes last year a 182 increase over 2018.

Tax amount varies by county. Jersey city property tax rate 2020 Read More. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON.

11604 00001 Principal. City of Jersey City. Online Inquiry Payment.

To search for tax information you may search by the 10 digit parcel number last name of property owner or site address. New Jerseys highest-in-the-nation average property tax bill hit 9112 last year. The median property tax in Hudson County New Jersey is 6426 per year for a home worth the median value of 383900.

It is equal to 10 per 1000 of taxable assessed value. POSSIBLE REASONS BEHIND STUDENT VISA REJECTION Read More. The average effective property tax rate in New Jersey is 240 which is.

From 2017 to 2018 they saw a 514 spike. City of Jersey City. Online Inquiry Payment.

This was state-driven pressure to increase the school tax in Jersey City. In fact rates in some areas are more than double the national average. Homeowners in New Jersey pay the highest property taxes of any state in the country.

6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. Implementing legislation is found in New Jersey Statutes Annotated Title NJSA. GMAT coaching in ChandigarhPunjab Read More.

The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. Jersey City was allocated 146 million in total ARP aid. Mayor Steve Fulop hailed the news on Twitter.

The average effective property tax rate in New Jersey is 242 compared with a national average of 107. Hudson County collects on average 167 of a propertys assessed.

Tax Bill Breakdown City Of Woodbury

New Jersey State Taxes 2021 Income And Sales Tax Rates

Vertes Agos Swiss Facades Rainscreen Cladding Facade Design Factory Architecture

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

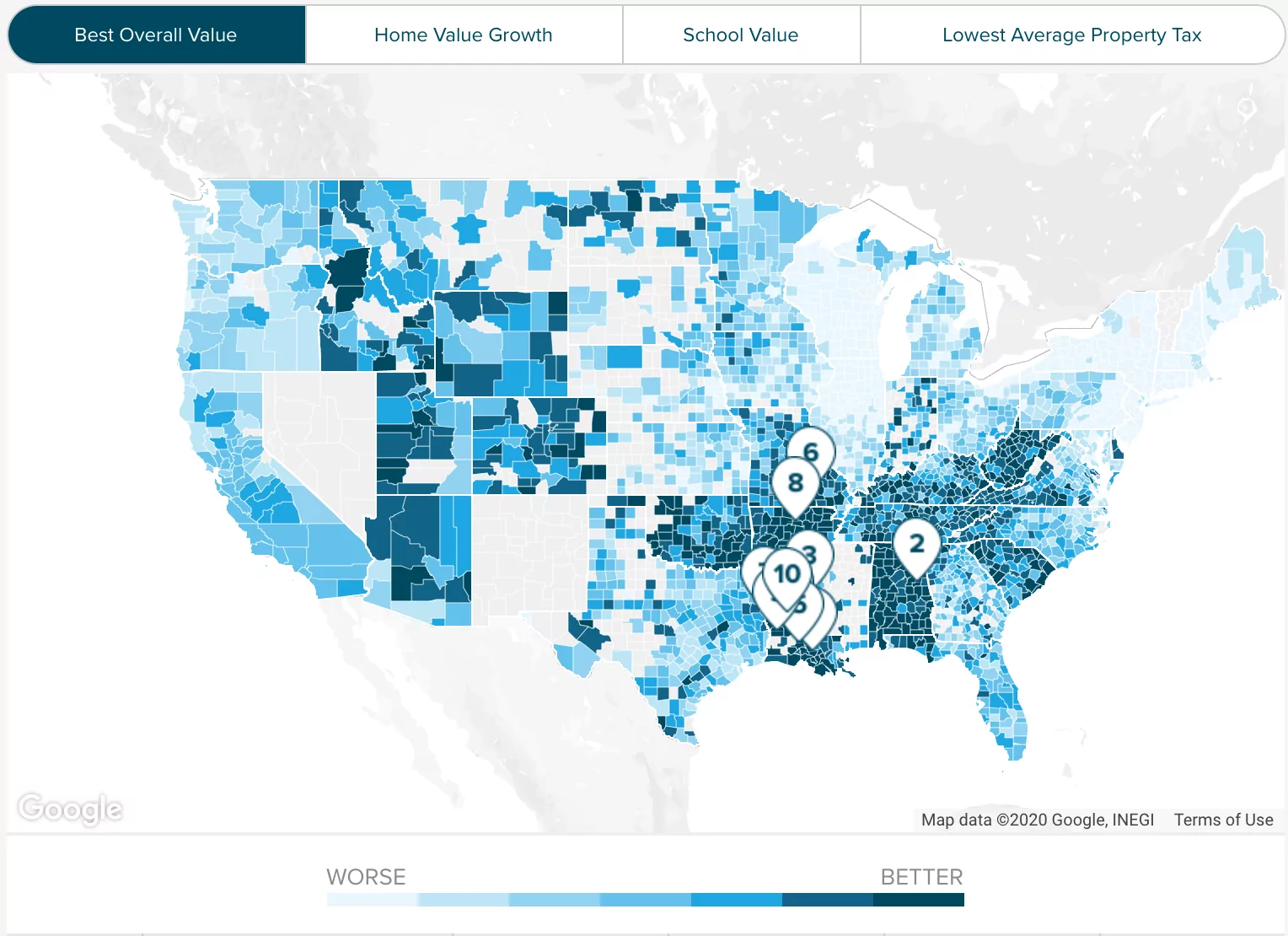

Property Taxes How Much Are They In Different States Across The Us

Harris County Tx Property Tax Calculator Smartasset

New Zillow Study Details Rental Cost Disparity Of City Vs Suburbs Real Estate Tips Zillow Suburbs

How Do State And Local Sales Taxes Work Tax Policy Center

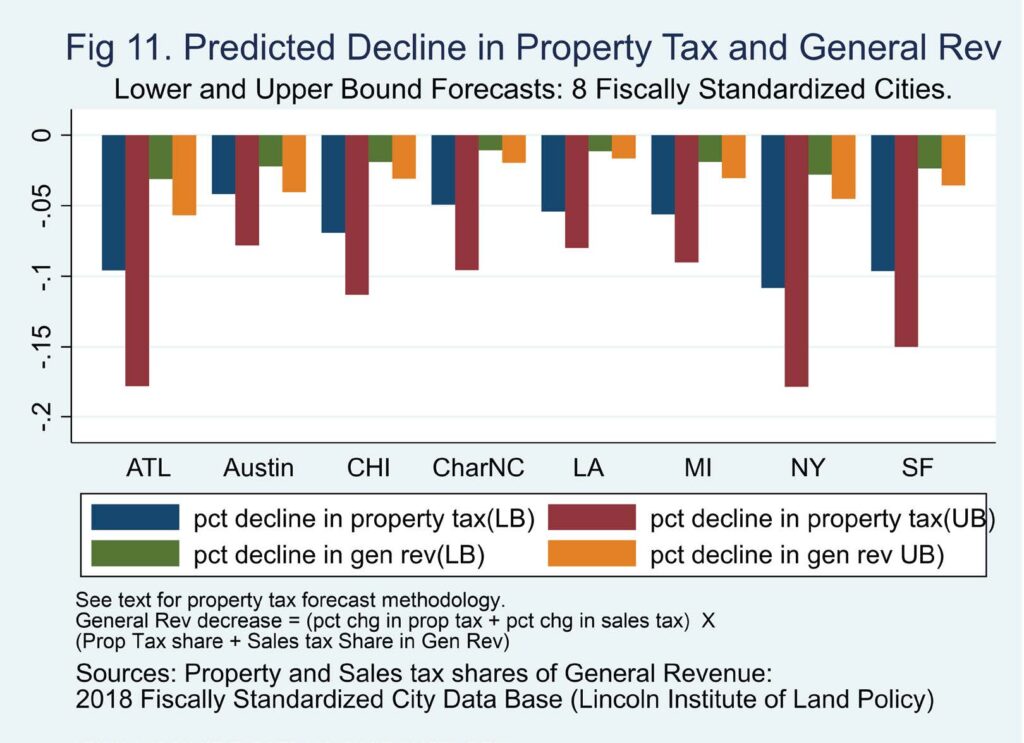

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Tax How To Calculate Local Considerations

Why Do New Jersey Residents Pay The Highest Taxes Mansion Global

Tax Information City Of Katy Tx

7 Tax Benefits Of Owning A Home A Complete Guide For Filing This Year Home Ownership Home Buying Tips Real Estate

New York Property Tax Calculator 2020 Empire Center For Public Policy